The unique program is specifically designed to comply with all FDIC requirements to ensure that it remains safe and secure. Insured Cash Sweep has been rigorously tested again and again using billions of dollars.

Although your funds may end up in accounts at other network institutions, your relationship remains between you and your financial institution. When you deposit funds using ICS services, your information remains confidential and protected.

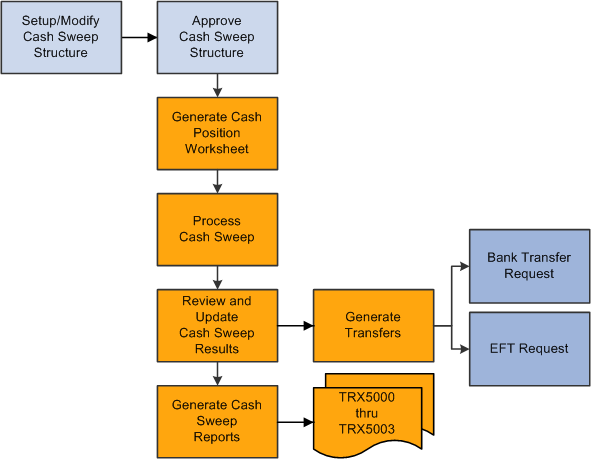

SWEEP ACCOUNT DEFINITION FULL

Interest rates are set by the customer’s chosen financial institution and the customer receives a bank statement that covers the full amount of the deposit. As the funds are spread across multiple banks in the network, the amount remains below the $250,000 FDIC limit at each bank and the customer remains eligible for the total amount of deposit insurance that is larger than the standard limit allowed at one bank. When placing a large deposit using ICS, your funds are placed into a demand deposit account, money market account, or both.Īlthough you are depositing your funds at a single bank, the financial institution can place received deposits into interest-bearing savings accounts at other in-network FDIC-insured banks.

All deposits made are handled through a network member of your choosing. Any financial institution that offers ICS services are included in a unique network known as the ICS Network. However, ICS service allows you to receive FDIC protection for millions of dollars while still being able to work with just one bank that offers this service. When depositing funds at a financial institution in a single ownership capacity, you have the ability to access up to $250,000 in Federal Deposit Insurance Corporation (FDIC) insurance at that bank.

SWEEP ACCOUNT DEFINITION PROFESSIONAL

Learn more about Insured Cash Sweep, how it works, and why you should speak with a business banking professional about using this secure and convenient service. Not all banks and savings associations offer ICS at this time. You can also continue earning interest on any funds that are placed into a demand deposit account or money market deposit account. Insured by the Federal Deposit Insurance Corporation, Insured Cash Sweep (ICS) is a service that allows you to secure large deposits while still maintaining access to your funds.

0 kommentar(er)

0 kommentar(er)